CASE STUDY | UNOVIS ASSET MANAGEMENT

Created new connections with investors and industry stakeholders, contributing to the close of its second $150M+ USD fund

Unovis Asset Management was created to transform the global food system to one that is more sustainable from the perspectives of the environment, food scarcity, health, and animal protection. It accomplishes this by investing in alternative protein companies, including those working on plant-based, cellular agriculture and novel protein innovations.

Challenges

With a team spread across three continents and investments in companies worldwide, Unovis was struggling to communicate its value prop across all of its diverse stakeholders as well as potential investors. The alternative protein industry is both a very small world as well as one that is very distributed across regions. Active since 2016, Unovis is one of the oldest investment funds in the industry, but telling its story and reaching new audiences became challenging as alternative protein moved into the mainstream.

Achieved Results

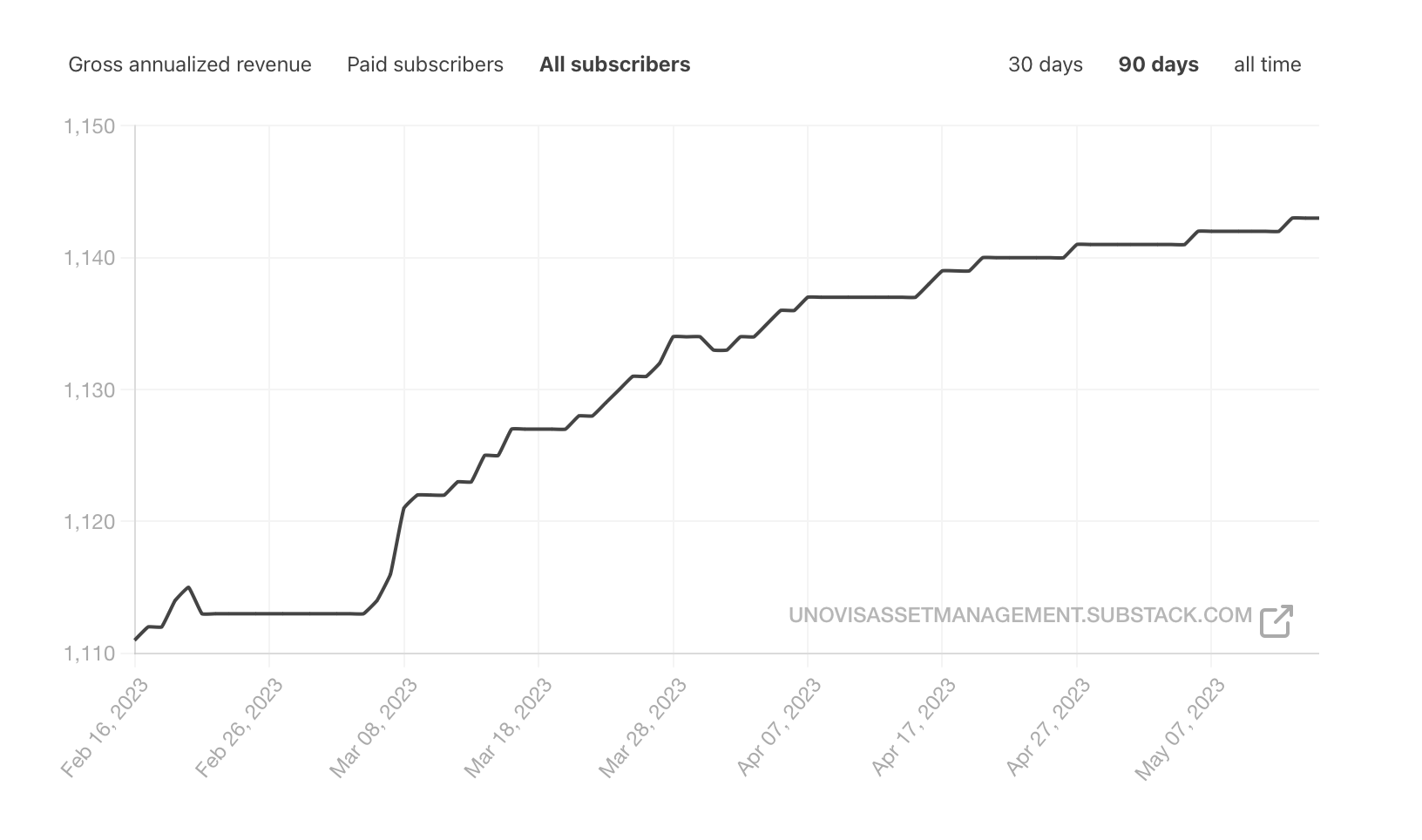

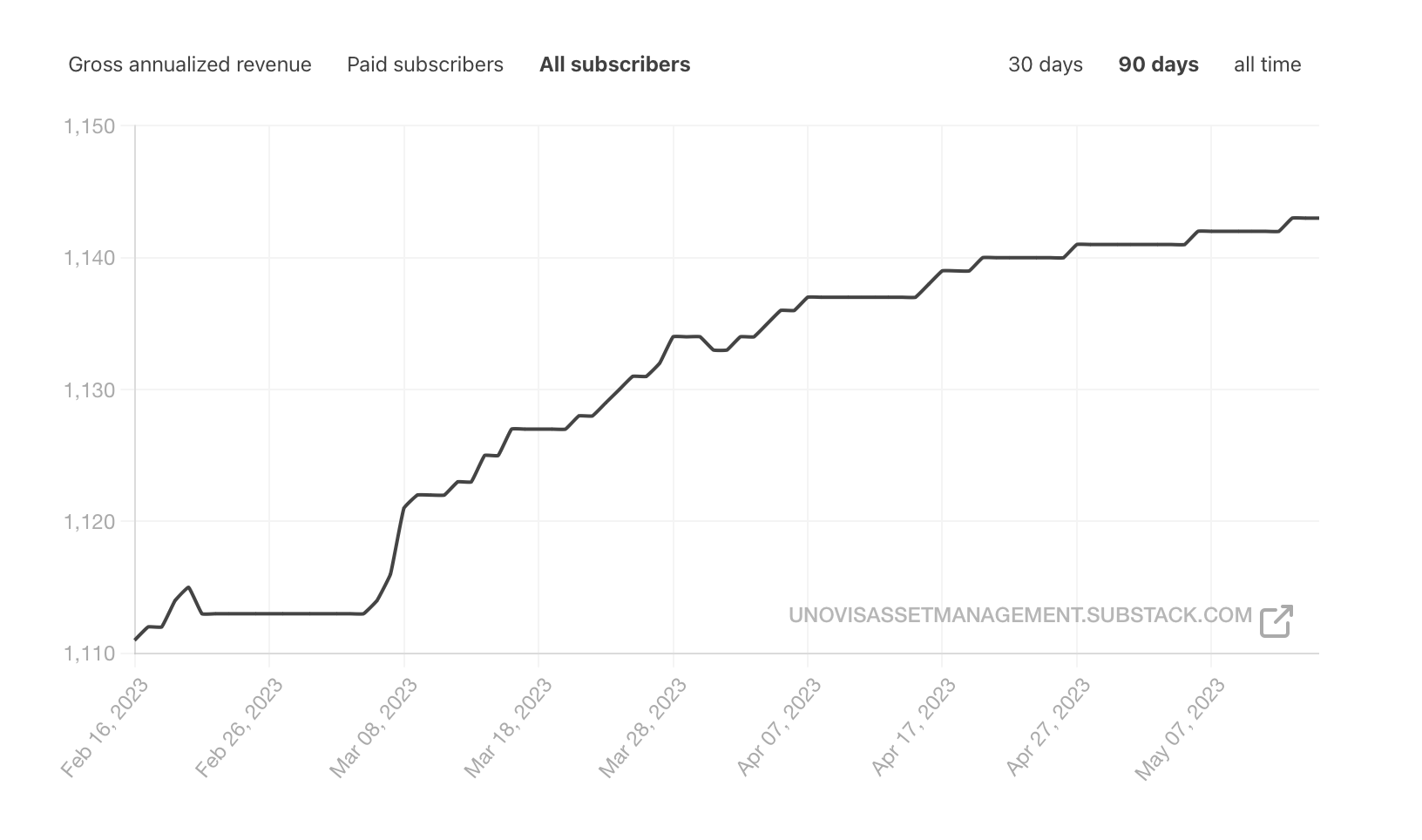

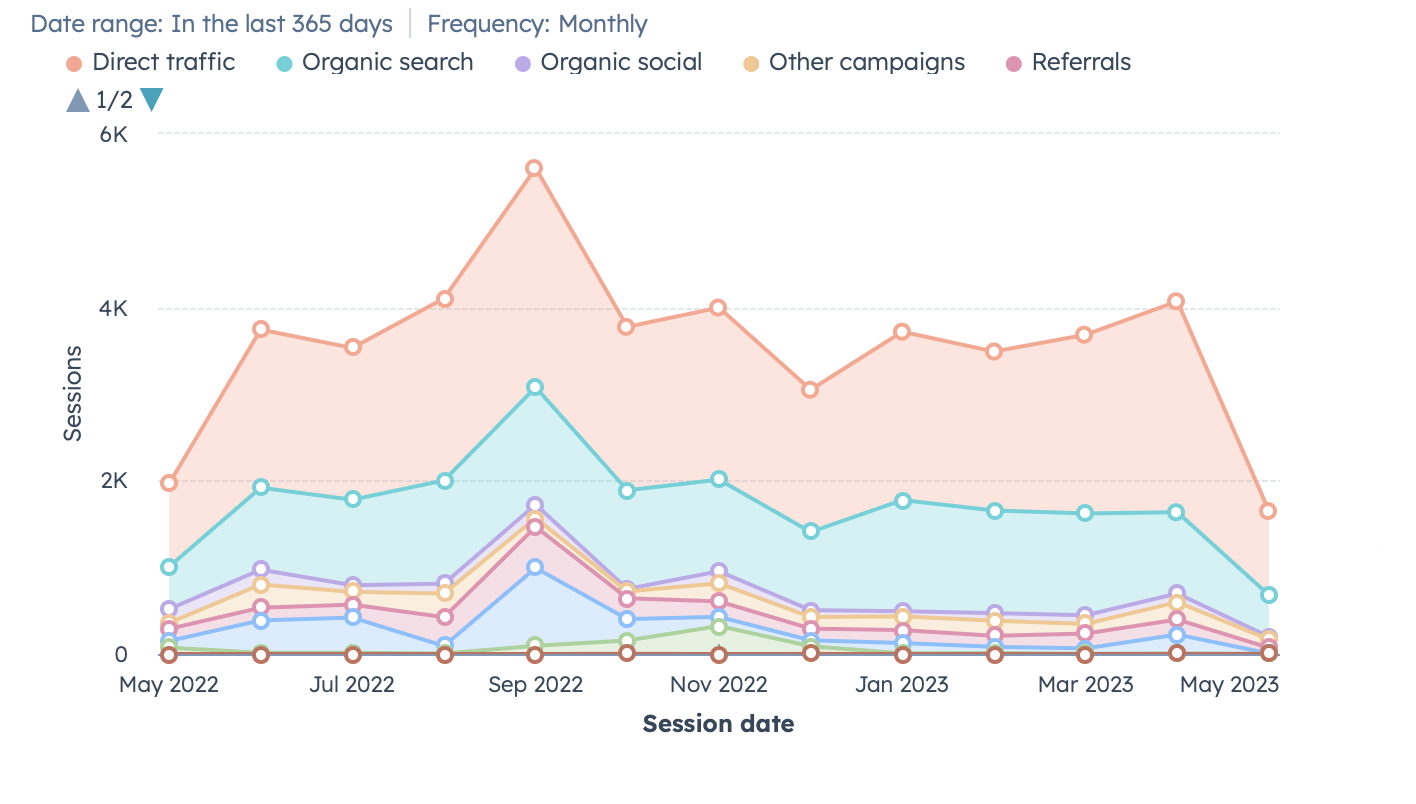

Layup Content created for Unovis a unified content and social media strategy, including weekly thought leadership posting by the firm's principals, daily content activation, a monthly email newsletter, lead gen automation and monthly metrics reporting.

This holistic approach has helped Unovis:

Client

Unovis Asset Management

Industry

Venture Capital

Vertical

Alternative Protein

Results

Created new connections with investors and industry stakeholders, contributing to the close of its second $150M+ USD fund

Hold on, There's more

Explore more Success Stories From Our Existing VC Marketing Partners

Implemented A Predictable Growth Strategy & Increased AUM

Engaged With New Investors And Increased AUM

Increased AUM More Than 20x Over The Course Of 5+ Years

Closed their Second $150M+ USD Fund