CASE STUDY | iSELECT Fund

Increased AUM more than 20x over the course of 5+ years

Based in St. Louis, Missouri, iSelect is a new kind of venture fund, dedicated to connecting investors with high-growth startup companies across Agriculture and Healthcare, with the stated goal of improving the global food system. Unlike typical venture funds, iSelect’s offerings are more accessible, open to all investors who qualify as a way to open up new access to the long-closed venture capital asset class.

Challenges

The fund was well established and growing when it first approached Layup Content for help with its content and messaging, but it needed to prove its value and expertise to the marketplace via thought leadership and insights that its competitors couldn’t match. The iSelect team includes a number of subject matter experts and experienced operators in its markets, but the fund wasn’t leveraging their networks and knowledge like they could.

Achieved Results

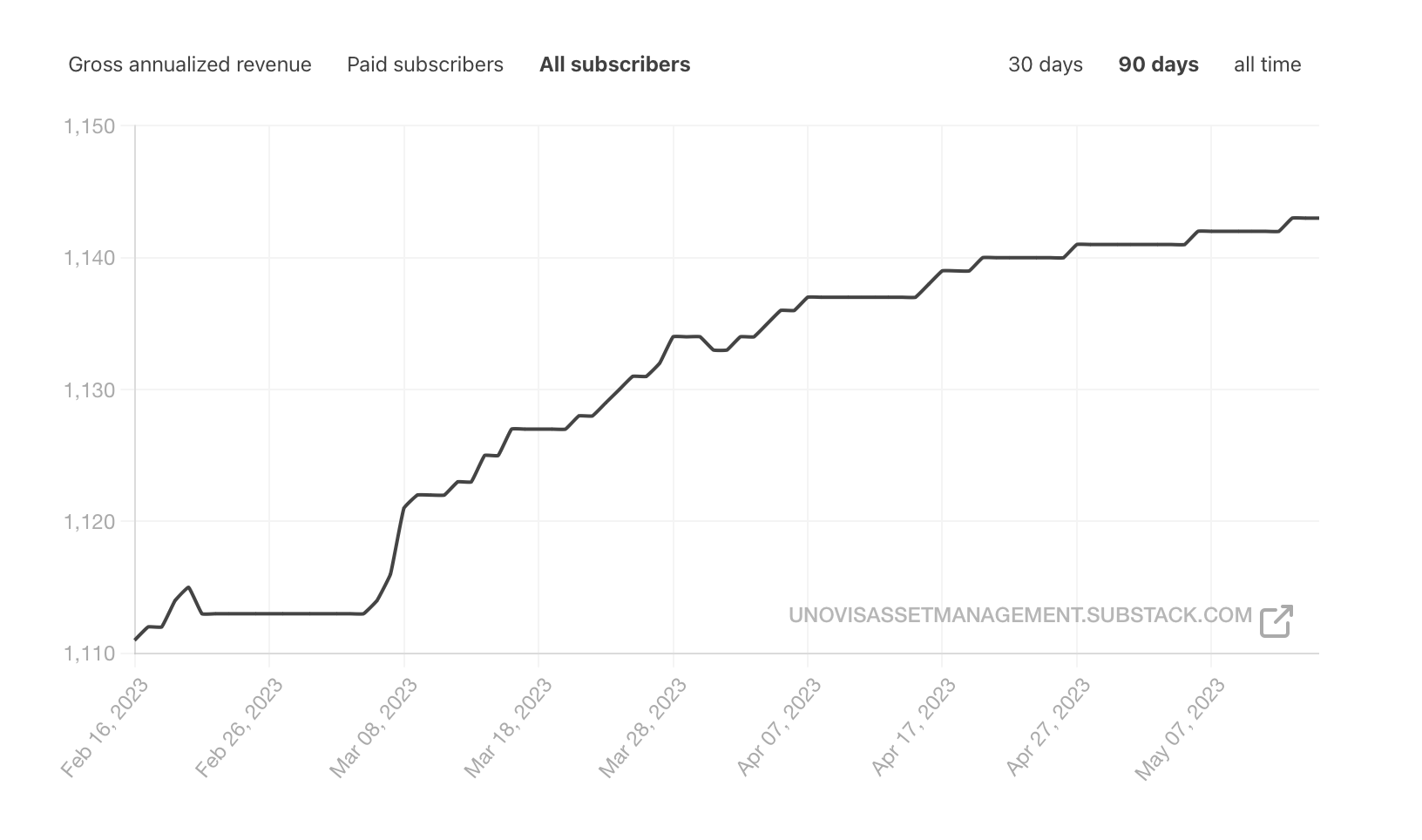

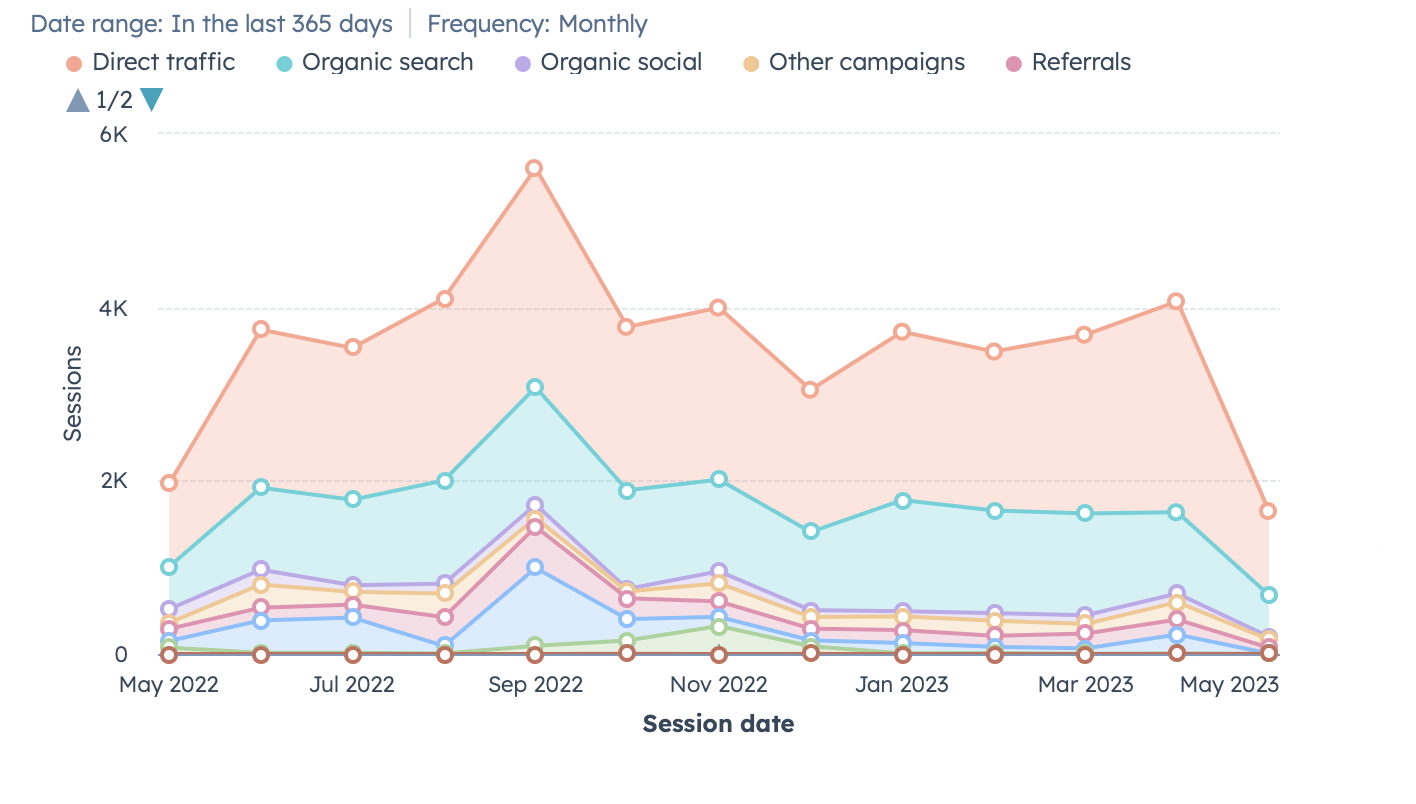

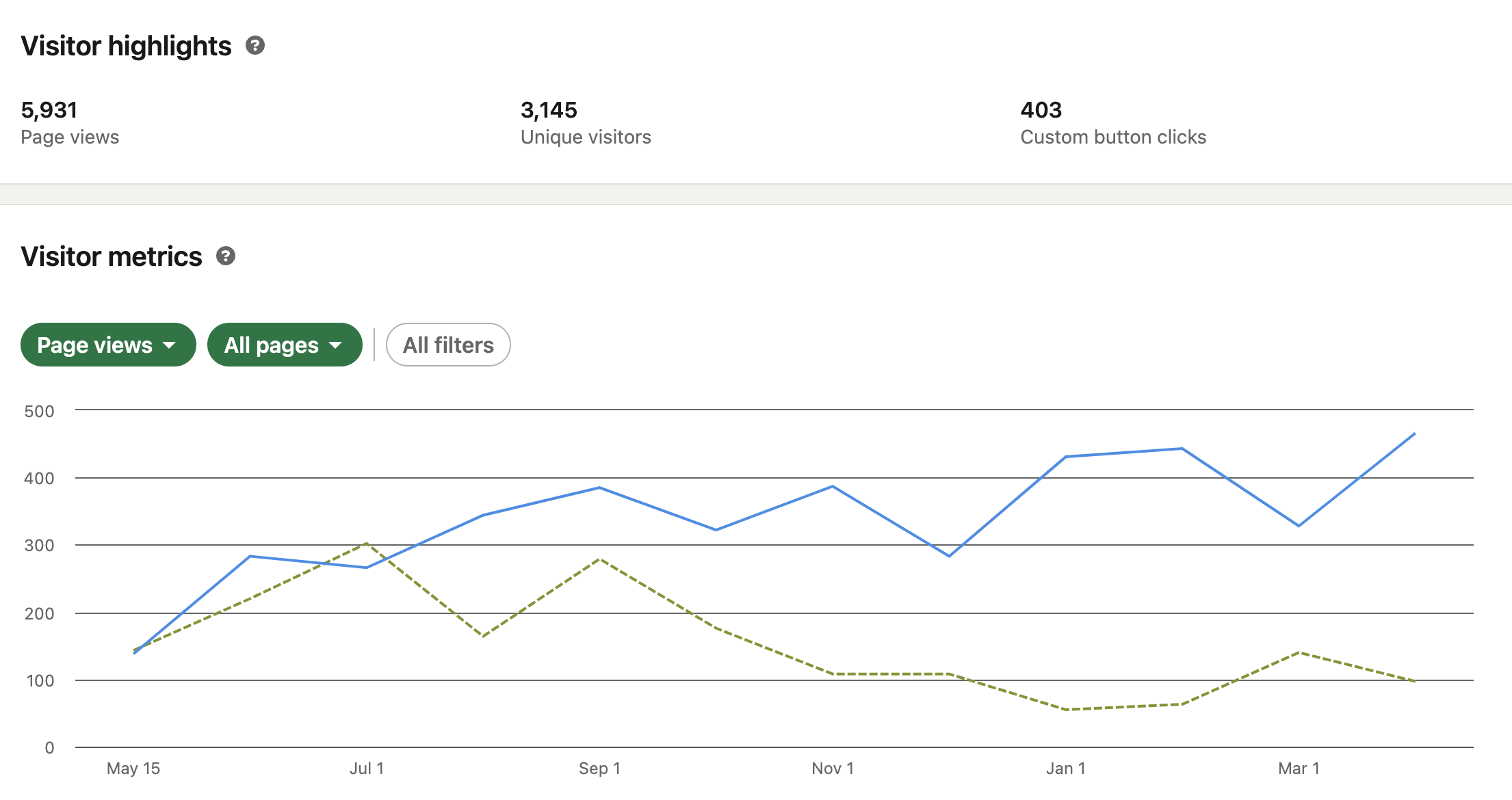

Once we established a strong messaging and content strategy for iSelect, the fund started seeing increased engagement across all of its sales channels and saw steady growth in assets under management (AUM). iSelect’s engagement with Layup Content today includes thought leadership campaigns, email marketing, social media strategy, inbound content, media outreach and more.

Since starting work with us, iSelect has:

Client

iSelect Fund

Industry

Venture Capital

Vertical

Agriculture Technology and Food

Results

Increased AUM more than 20x over the course of 5+ years

Hold on, There's more

Explore more Success Stories From Our Existing VC Partners

Implemented A Predictable Growth Strategy & Increased AUM

Engaged With New Investors And Increased AUM

Increased AUM More Than 20x Over The Course Of 5+ Years

Closed their Second $150M+ USD Fund