CASE STUDY | Dao Foods International

Engaged with new investors and increased AUM

Dao Foods is an impact-oriented investment firm that invests in plant-based and alternative protein companies based in mainland China and focused on the Chinese market, as well as non-Chinese companies that have some strategic value to China. Its mandate is to support entrepreneurs that can play a role in activating the Chinese consumer, serving as their investor, their cheerleader and their value-added partner. Founded by experienced impact investors and social entrepreneurs, the Dao Foods international network is committed to identifying, assessing and supporting the most promising companies in China’s plant-based and alternative protein sector.

Challenges

Dao Foods occupies a unique space in the venture capital ecosystem, straddling the line between a for-profit investment fund and a non-profit economic development organization. Although the alternative and plant-based protein industries are well established and growing internationally, they remain nascent in China, where tastes remain rooted in traditional protein and change is slow. That said, a growing younger generation is looking for healthy alternatives, driving new interest in alternative proteins. In order to support this work, the company invests in Chinese startups, hosts accelerator programs and participates in ecosystem building activities. Dao Foods approached Layup Content to help it communicate its value proposition to the international investors it needs to support this work.

Achieved Results

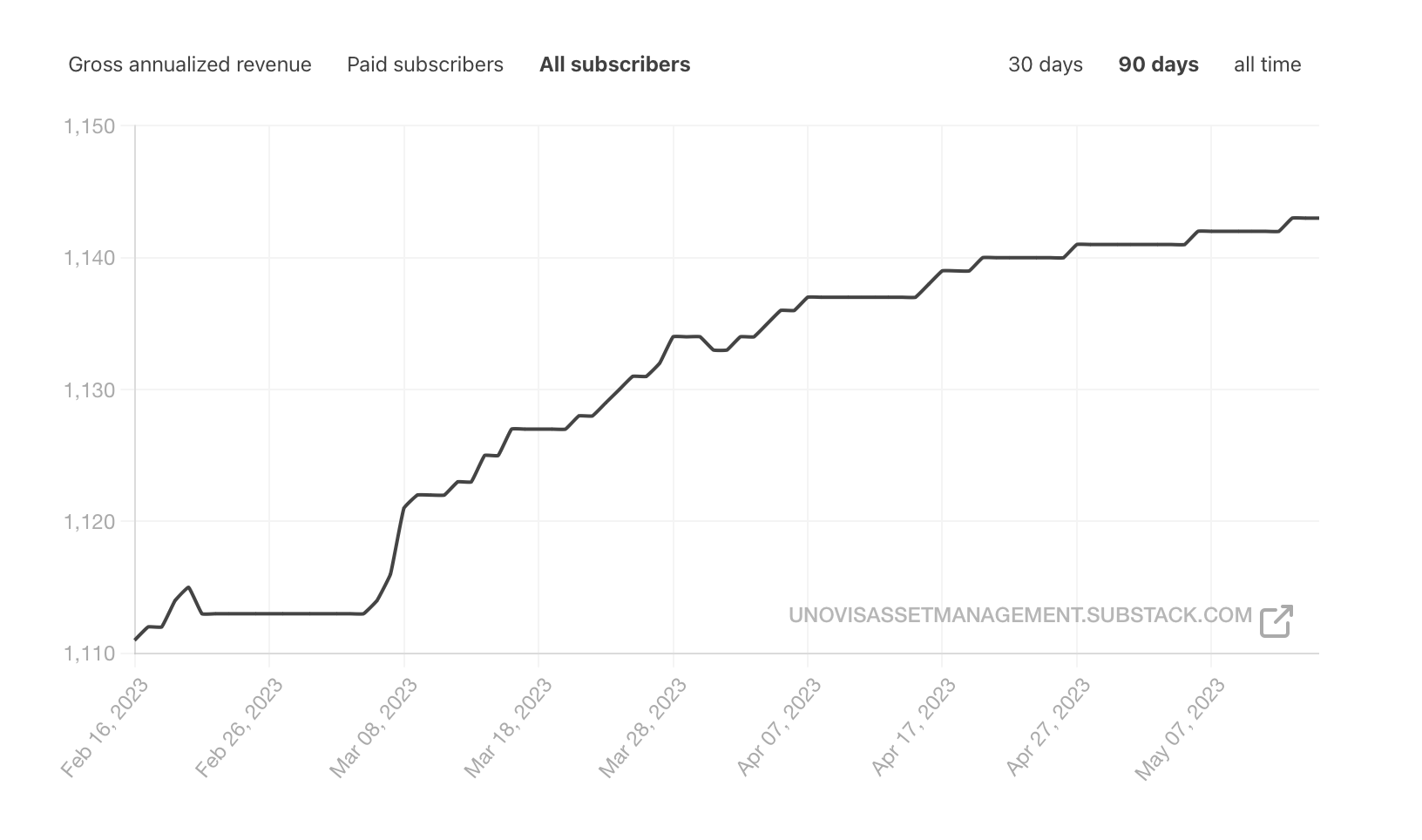

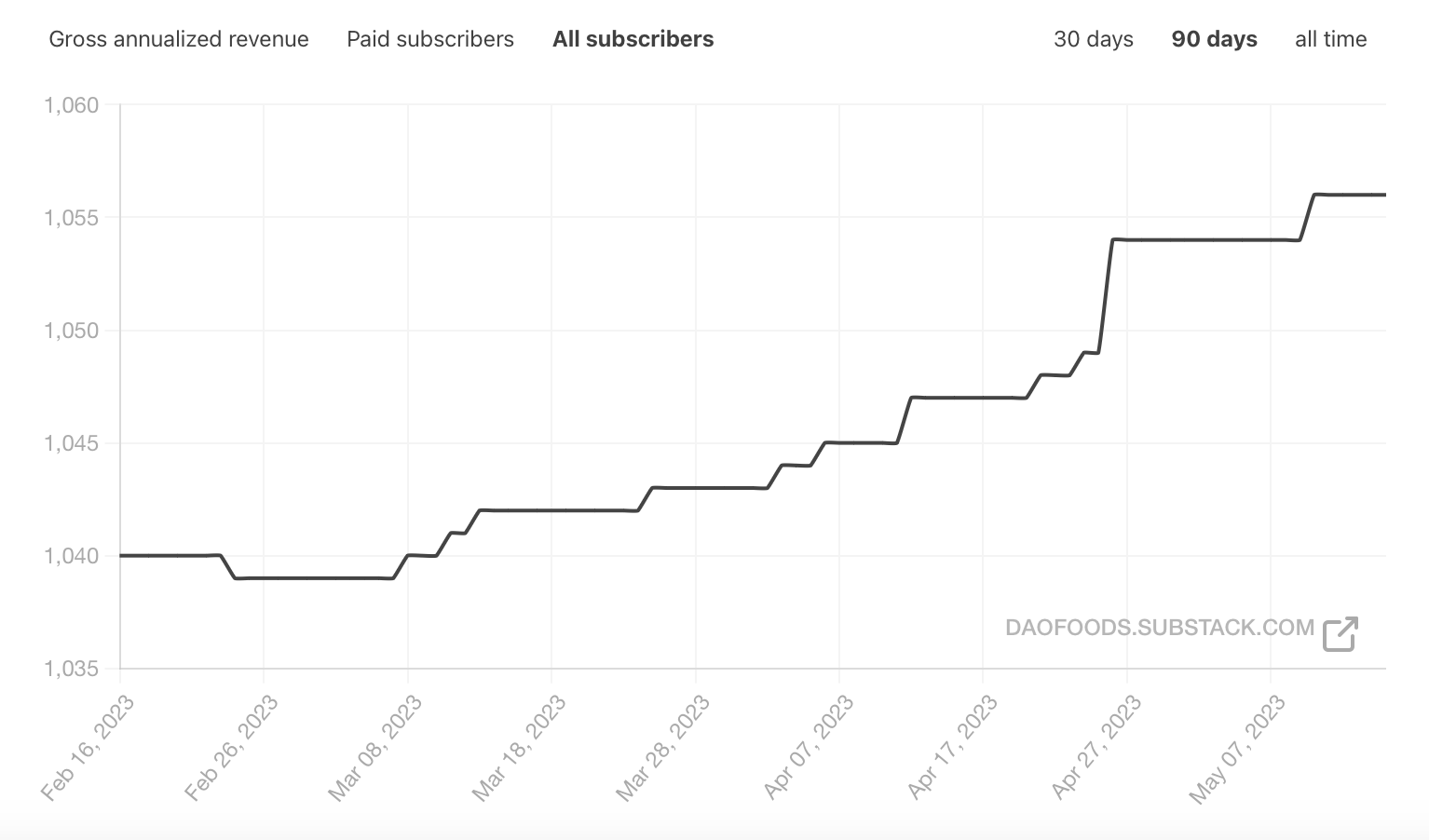

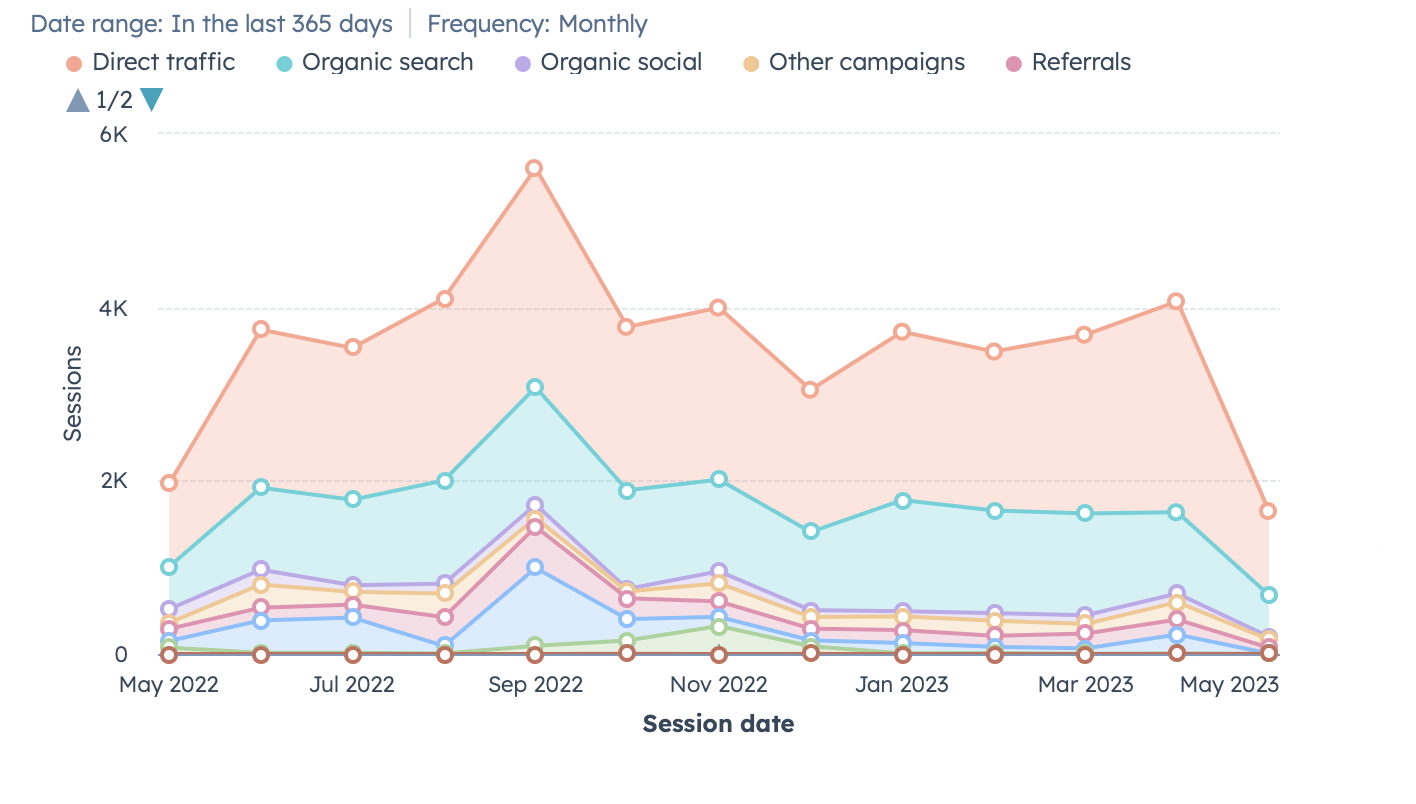

Layup Content created a full communications and messaging strategy for Dao Foods focused on the international audience, including social media activation, a website overhaul, thought leadership, blogging and PR outreach. Once active, the fund started seeing increased engagement and inbound interest in the work it was doing. Most importantly, conversations with investors were backed up by the social proof needed to help convince them that investing in China was an opportunity not to be overlooked.

Since starting work with us, Dao Foods has:

Client

Dao Foods International

Industry

Venture Capital

Vertical

Alternative Protein, Food System

Results

Engaged with new investors and increased AUM

Hold on, There's more

Explore more Success Stories From Our Existing VC Partners

Implemented A Predictable Growth Strategy & Increased AUM

Engaged With New Investors And Increased AUM

Increased AUM More Than 20x Over The Course Of 5+ Years

Closed their Second $150M+ USD Fund